how to get tax exempt certificate ohio

Open the doc and select the page that needs to be signed. Florida Illinois Kansas Kentucky Maryland Nevada Pennsylvania South Dakota and Virginia.

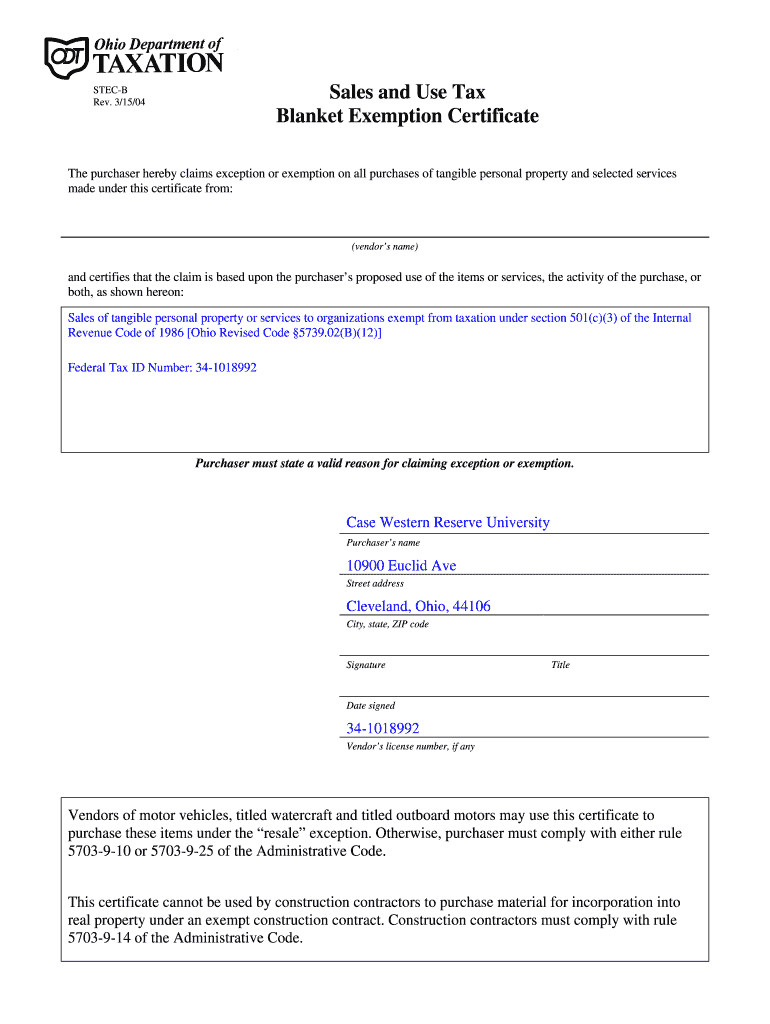

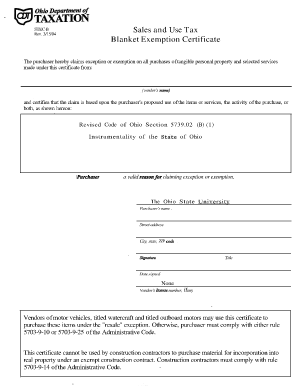

Case Western Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

If you hold a tax exemption certificate in one of these states make sure you renew as required to avoid possible penalties.

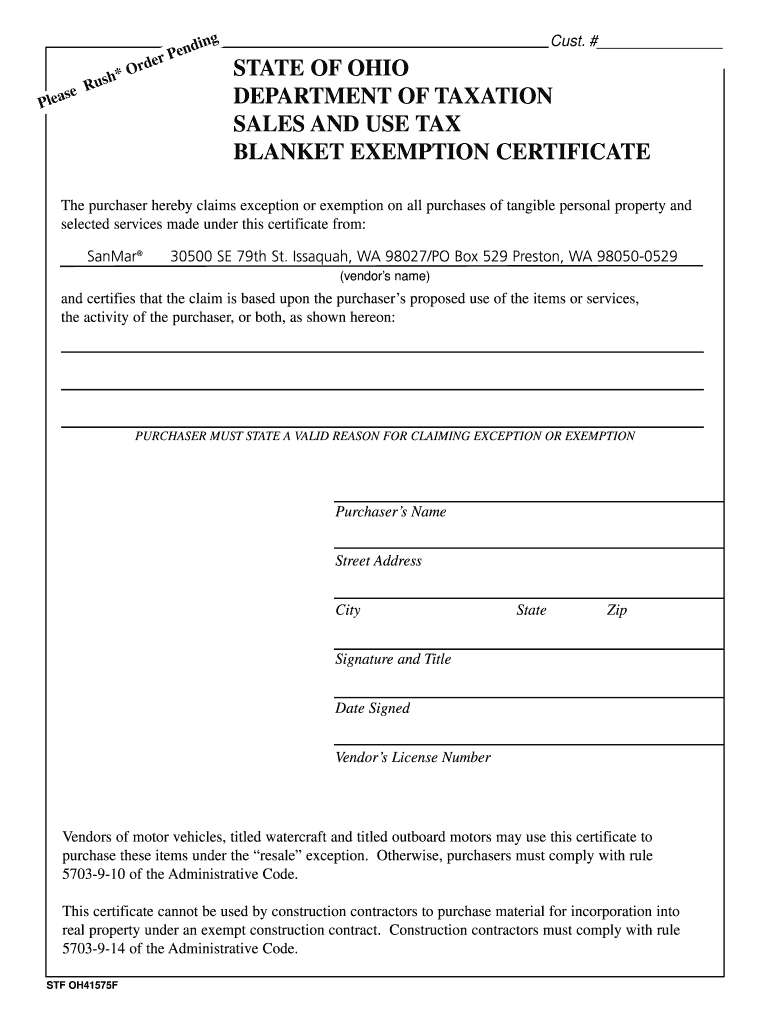

. How many acres do you need to be tax exempt in Ohio. Step 2 Enter the vendors name Step 3 Describe the reason for claiming the sales tax exemption. State Tax Exempt Certificate Simple Online Application.

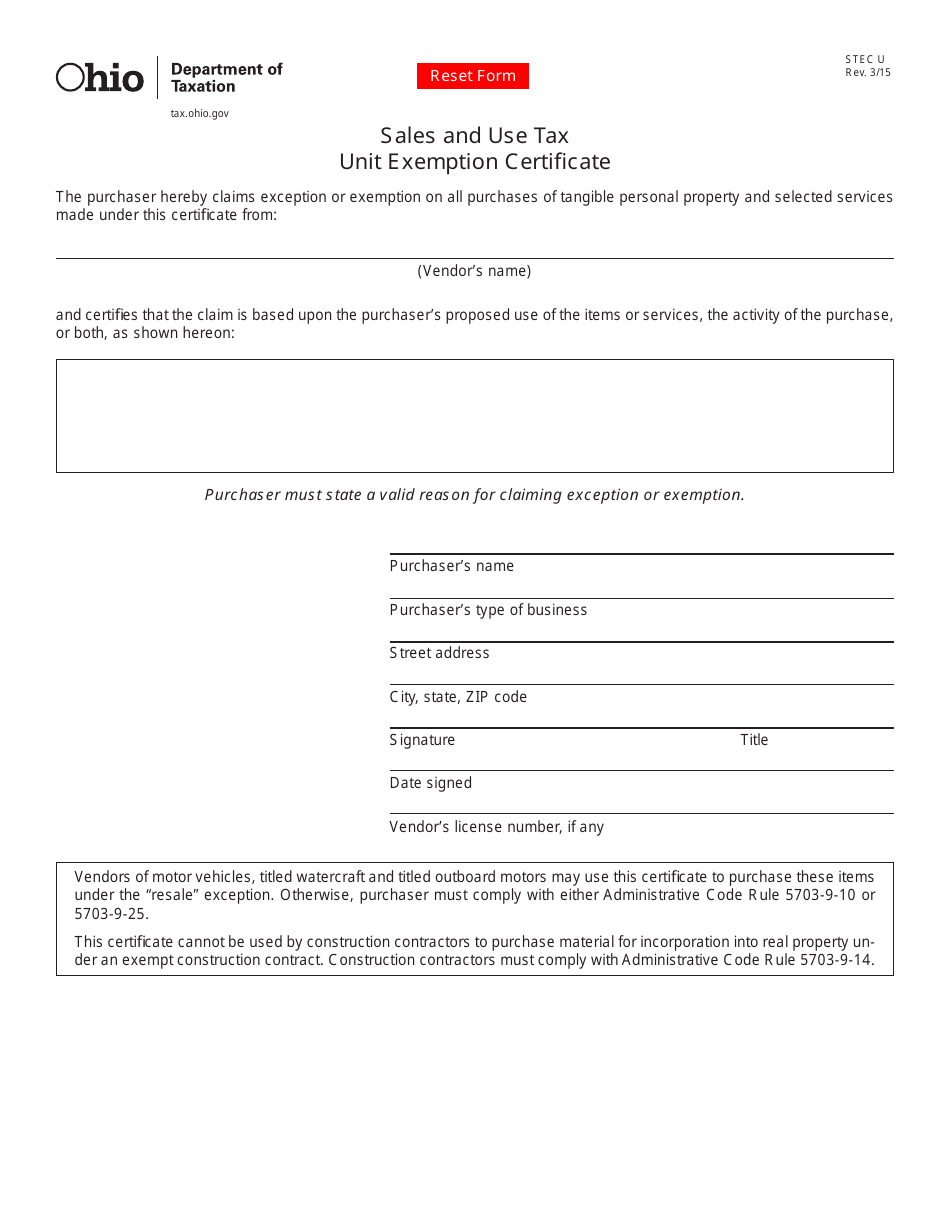

Obtain an Ohio Vendors License. How to use sales tax exemption certificates in ohio. Vendors name and certifi or both as shown hereon.

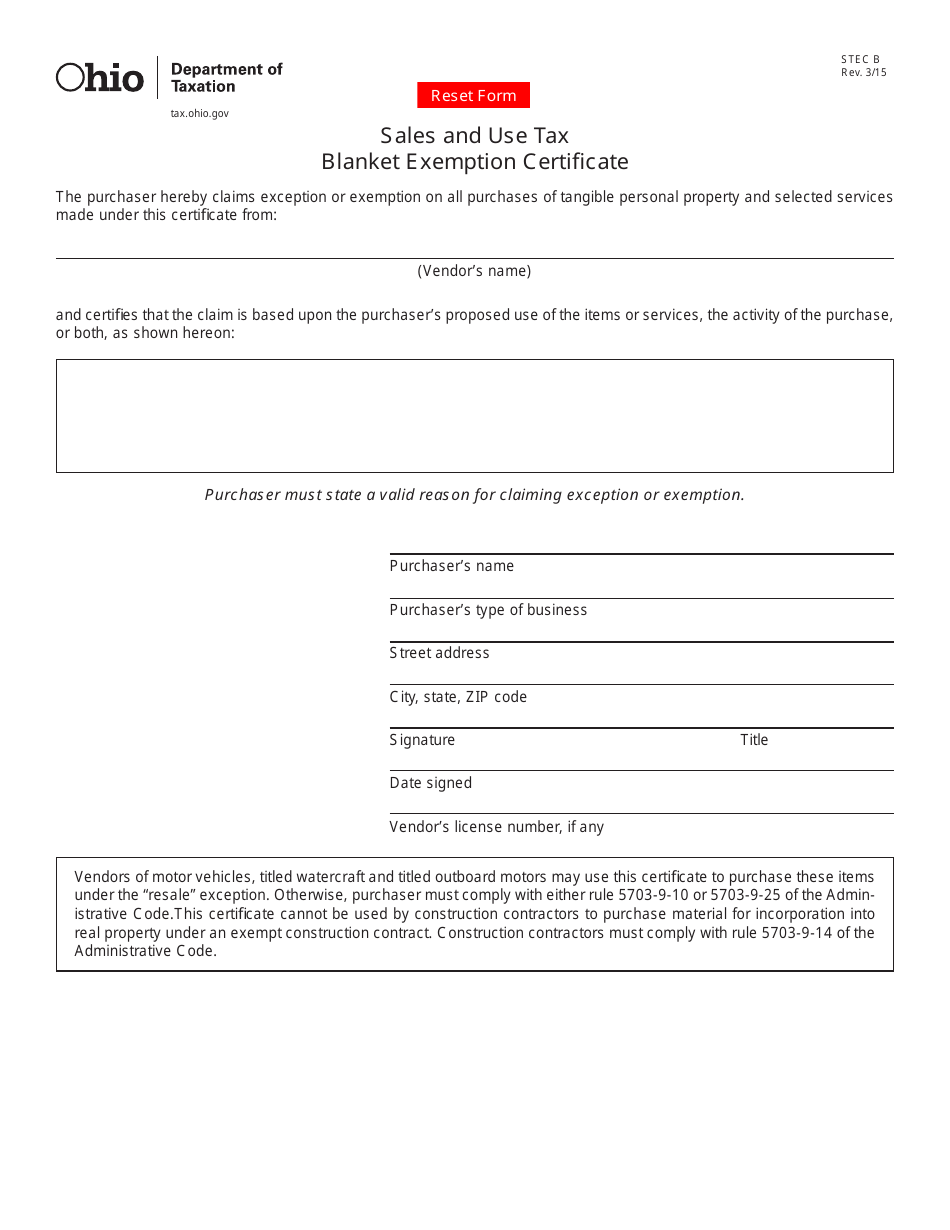

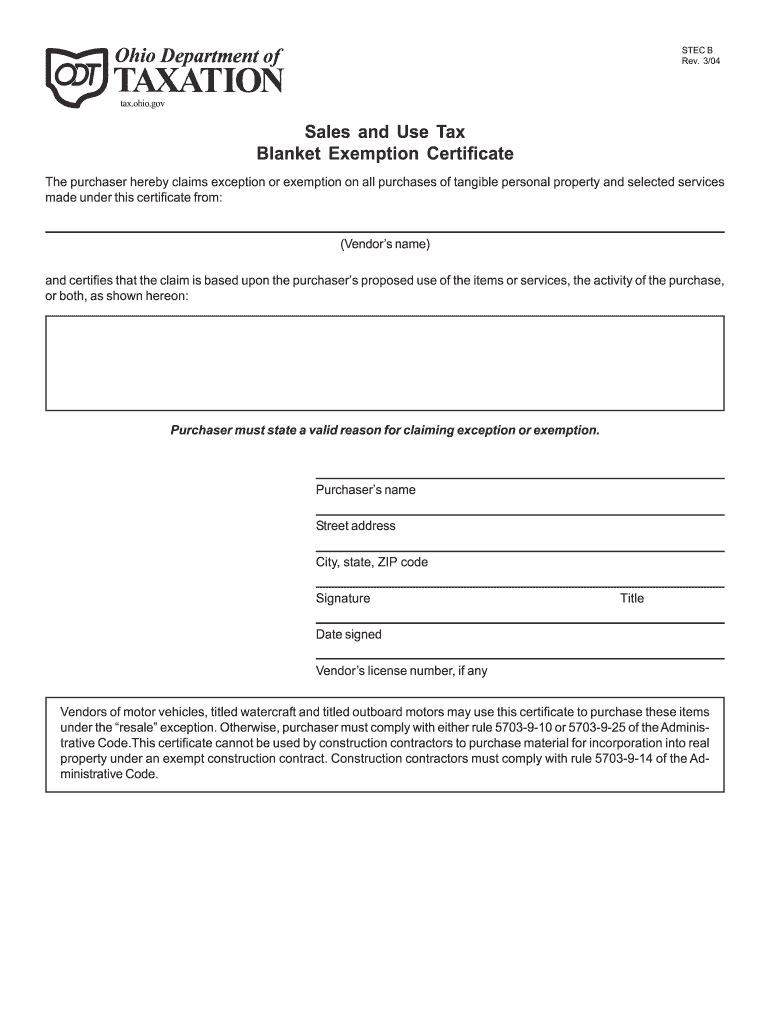

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. If you Wish to Use an Ohio Resale Certificate. Certificates last for five years in at least 9 states.

You either need to have more than 10 acres excluding your home site or you need to make at least 2500 a year off whatever acreage you do have. In instances where similar transactions routinely occur between a buyer and a seller. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

Sales and Use Tax Blanket. State-issued exemption and resale certificates can be found on a state tax authoritys website. The land must be devoted exclusively to commercial ag use for the three preceding years and remain that way for all the years you are enrolled.

In turn the tax-exempt certificate is kept by the seller which gives them the go-ahead to transact with the. What if my non-profit plans on selling items. Get tax-exempt form Ohio signed right from your smartphone using these six tips.

How to use sales tax exemption certificates in Ohio. If you plan on selling taxable items your OH non-profit is still required to collect and remit sales tax. Obtain the tax exempt certificate you require from the Ohio Department of Taxation taxohiogov.

Does anyone have a link to the what form I have to fill out to get sales tax exmption for the state of Ohio. Step 2 Enter the vendors name. I uploaded my reseller certificate and ebay rejected it saying I need a tax exempt certificate.

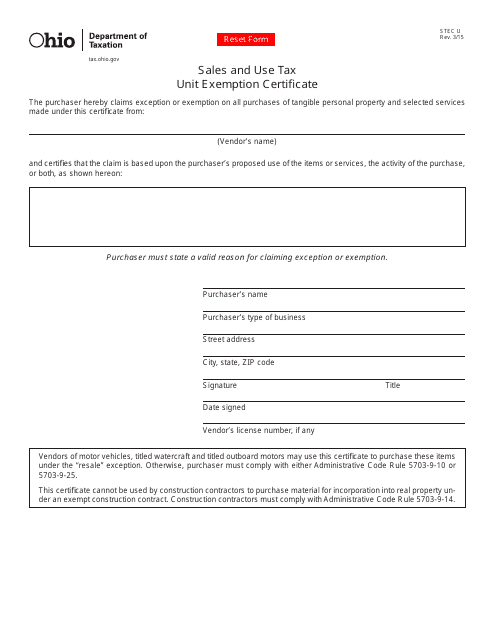

I thought they were the same thing. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Ohio will need to see your IRS Determination letter.

As of January 5 2021 Form 1024-A applications for recognition of exemption. Fill out the Ohio sales tax exemption certificate form. Filling out the Exemption Certificate is pretty straightforward but is critical for the seller to gather all the information.

Complete the Type of Business Section. If purchasing merchandise for resale some wording regarding the resale of products will. Steps for filling out the ohio sales and use tax exemption certificate.

There are often different certificates for different situations or industries as seen on the New York State Department of Taxation and Finance Exemption Certificates for Sales Tax page. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Step 3 Describe the reason.

Once you have that you are eligible to issue a resale certificate. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Learn more at our Ohio Tax page.

For this you will need a. In most cases it is the responsibility of a buyer to fill out the tax-exempt certificate at the point of purchase. Use a blanket certificate which has no expiration date to cover all purchases you make from a vendor from the date you provide the certificate.

Ad Download Or Email Form 2058-1 More Fillable Forms Register and Subscribe Now. As of january 31 the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov. Ad State Tax Exempt Certificate Wholesale License Reseller Permit Businesses Registration.

PdfFiller allows users to edit sign fill and share all type of documents online. If youre making multiple purchases you want to use form STEC B. In general a tax-exempt certificate is a document that allows a buyer to conduct tax-free transactions of goods and services that qualify for such a tax break.

Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses. Applying for Tax Exempt Status. If you dont have an account yet register.

Keep in mind there are two different forms depending on if youre making a one-time sales tax-exempt purchase or if you plan on making ongoing purchases. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov.

Be aware that there are several types of exemption certificates. Purchaser must state a valid reason for claiming exception or exemption. You can apply for a Sales and Use Tax Blanket Exemption Certificate that you provide to vendors if you are an IRS 501c nonprofit.

Step 2 Enter the vendors name. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Search for the document you need to electronically sign on your device and upload it.

Tax exemption certificates last for one year in Alabama and Indiana. Ad STF OH41575F More Fillable Forms Register and Subscribe Now. Sales and Use Tax Blanket Exemption Certificate.

Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number. The process of using a resale certificate for Ohio isnt difficult.

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

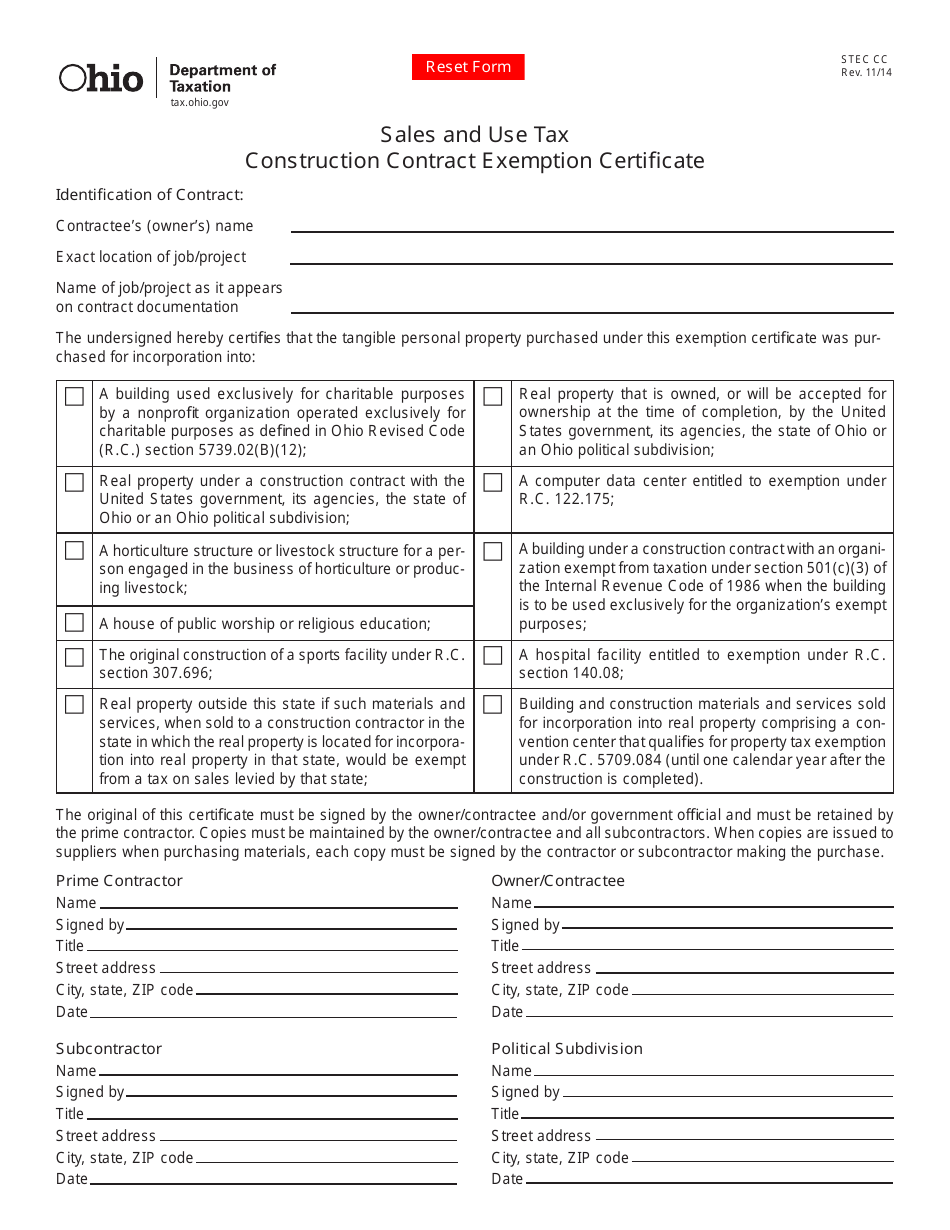

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Exemption Certificate Forms Department Of Taxation

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Ohio Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Free Form Stec U Sales And Use Tax Unit Exemption Certificate Free Legal Forms Laws Com

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller